Final Investment Decisions (FID) are a critical milestone in the lifecycle of energy projects, particularly in capital-intensive sectors such as oil and gas, power generation, and renewable energy. An FID represents a company’s formal commitment to proceed with the construction phase, based on feasibility studies, cost estimates, and stakeholder alignment. However, delaying FID can introduce significant hidden risks that may not be immediately apparent, jeopardizing project timelines, budgets, and overall viability.

This article explores the hidden risks of delayed FIDs, their implications on energy projects, and strategies to mitigate these challenges.

Understanding Final Investment Decisions (FID)

FID marks the point at which a project transitions from the planning phase to execution. It is informed by a comprehensive evaluation of factors such as:

- Technical Feasibility: Engineering designs, environmental impact assessments, and regulatory compliance.

- Economic Viability: Capital cost estimates, market forecasts, and financial models.

- Stakeholder Approval: Alignment among investors, contractors, and regulatory bodies.

A timely FID ensures resources are mobilized efficiently, supply chains are secured, and project schedules are adhered to. Conversely, delays in FID can cascade into broader project risks.

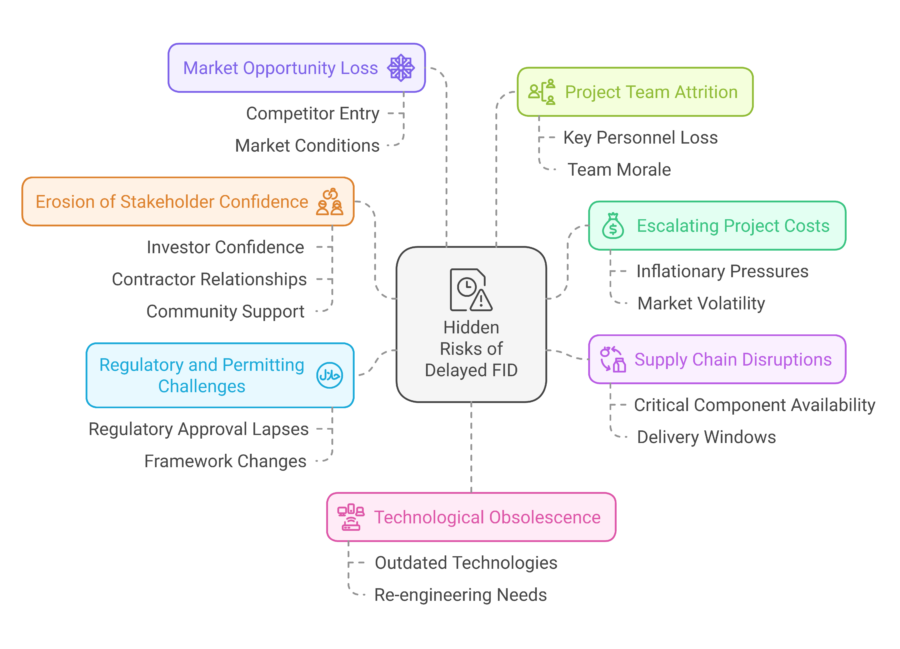

Hidden Risks of Delayed FID

Escalating Project Costs

Delays in FID often result in cost escalations due to:

- Inflationary Pressures: Rising prices for materials, equipment, and labor during the delay period.

- Market Volatility: Fluctuations in commodity prices, exchange rates, and interest rates that affect procurement and financing.

For example, a delayed FID for an offshore oil platform may expose the project to steel price increases or higher borrowing costs, inflating the overall budget.

Supply Chain Disruptions

Energy projects rely on long-lead equipment and materials that require early procurement. A delayed FID can:

- Jeopardize the availability of critical components, such as turbines or compressors.

- Lead to missed delivery windows, causing further schedule slippage.

Competing projects in the market may secure limited resources first, leaving delayed projects to pay premiums or face prolonged waits.

Regulatory and Permitting Challenges

Many industrial projects require compliance with strict environmental and safety regulations. Delays in FID can:

- Lead to lapses in regulatory approvals, requiring re-submissions and additional reviews.

- Trigger changes in regulatory frameworks, particularly in volatile political environments.

For instance, a delayed FID for a renewable energy project may face new permitting requirements, delaying construction further.

Erosion of Stakeholder Confidence

FID delays can undermine the confidence of key stakeholders, including:

- Investors: Perceived project instability may lead to withdrawal or increased risk premiums.

- Contractors: Hesitation in decision-making can strain relationships and reduce contractor engagement.

- Communities: Prolonged uncertainty may erode support from local communities and advocacy groups.

Market Opportunity Loss

Energy projects are often time-sensitive, targeting specific market opportunities. Delayed FID can:

- Allow competitors to enter the market first, capturing early mover advantages.

- Miss favorable market conditions, such as high energy prices or tax incentives.

For example, a delayed FID in a liquefied natural gas (LNG) export terminal could miss lucrative contracts in a growing market.

Project Team Attrition

Prolonged delays can result in:

- Loss of key personnel due to uncertainty and inactivity.

- Reduced morale and motivation among project teams.

Rebuilding project teams after a delay can be costly and time-consuming, further impacting the project’s execution timeline.

Technological Obsolescence

In sectors with rapid technological advancements, delayed FIDs can:

- Render previously selected technologies outdated or inefficient.

- Require re-engineering and additional capital expenditure to incorporate newer technologies.

Summary of Risks

Risk | Description | Potential Impact |

Escalating Costs | Rising material, equipment, and labor costs due to inflation and market volatility | Increased overall project budget |

Jeopardized availability of critical components, missed delivery windows | Delayed project schedules | |

Regulatory Challenges | Lapsed approvals or changing frameworks | Re-submissions and extended timelines |

Stakeholder Confidence | Erosion of investor and contractor trust | Higher risk premiums and reduced engagement |

Market Opportunity Loss | Missed favorable conditions or first-mover advantages | Lost contracts and competitive positioning |

Team Attrition | Loss of key personnel due to inactivity | Increased hiring costs and re-onboarding delays |

Technological Obsolescence | Outdated technologies requiring redesign or re-engineering | Additional capital expenditure |

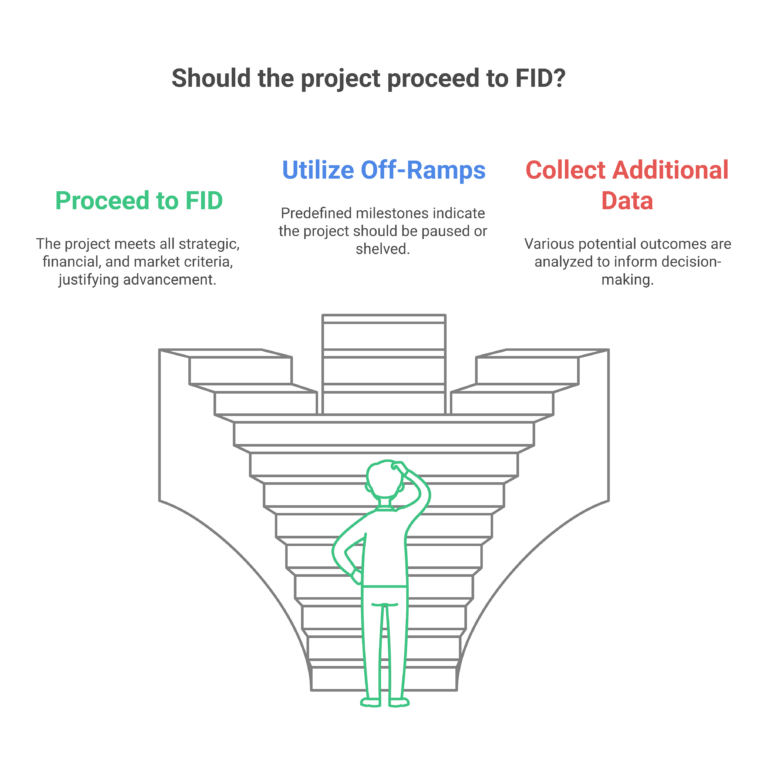

Not Every Project Should Reach FID

While FID is a critical step for advancing a project, not all projects should proceed to this stage. It is essential to have clear off-ramps and decision points to evaluate whether a project remains viable. Failing to recognize when a project no longer aligns with strategic, financial, or market conditions can result in sunk costs and wasted resources.

Data-Driven Decision-Making

- Decisions to advance a project should be grounded in robust data, not hope or belief. Market analysis, risk assessments, and economic models must take precedence over optimistic assumptions.

- Avoid the temptation to "chase sunk costs" by continuously investing in a project despite clear signs of diminishing returns or strategic misalignment.

Establishing Clear Off-Ramps

- Create predefined evaluation milestones during the pre-FID phase. These should include specific criteria for continuation, such as achieving regulatory approvals, securing market commitments, or meeting financial benchmarks.

- Use these off-ramps to objectively assess whether the project should move forward or be shelved.

Scenario Planning

- Develop best-case, worst-case, and most-likely scenarios to understand the full range of potential project outcomes. This allows stakeholders to make informed decisions about whether the project’s risks justify continued investment.

Lessons from Failed Projects

- Analyze past projects that failed after FID to identify warning signs that were overlooked during earlier stages. Incorporate these lessons into the decision-making framework to avoid repeating mistakes.

Leadership Accountability

- Ensure leadership teams are willing to make tough decisions to stop a project if data indicates that it is no longer viable. This requires a culture of transparency and accountability within the organization.

By integrating structured decision-making processes and embracing a realistic assessment of project viability, companies can prevent wasted resources and maintain focus on high-potential opportunities.

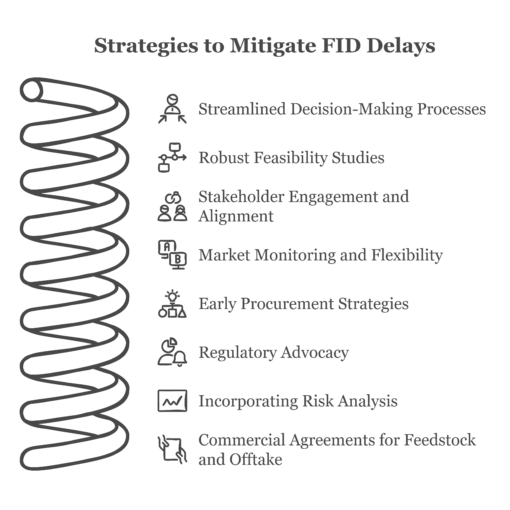

Strategies to Mitigate FID Delays

Streamlined Decision-Making Processes

- Establish clear governance structures with defined roles and responsibilities for decision-makers.

- Use decision-support tools, such as Monte Carlo simulations or scenario planning, to provide actionable insights.

Robust Feasibility Studies

- Conduct thorough feasibility studies early in the project lifecycle to reduce uncertainties.

- Incorporate contingency plans for potential risks identified during feasibility.

Stakeholder Engagement and Alignment

- Maintain regular communication with investors, regulators, and contractors to build trust and alignment.

- Use digital collaboration platforms to streamline stakeholder interactions and decision-making.

Market Monitoring and Flexibility

- Continuously monitor market conditions to identify optimal windows for FID.

- Design flexible project plans that can adapt to changing market dynamics.

Early Procurement Strategies

- Secure critical equipment and materials through advance procurement or reservation agreements.

- Negotiate flexible supply contracts to accommodate potential delays.

Regulatory Advocacy

- Engage with regulatory bodies early and consistently to ensure compliance and anticipate changes.

- Participate in industry groups to influence favorable regulatory environments.

Incorporating Risk Analysis

- Use tools such as risk registers and sensitivity analyses to quantify the impact of potential FID delays.

- Develop risk mitigation strategies and maintain contingency budgets.

Commercial Agreements for Feedstock and Offtake

- Secure long-term agreements for feedstock supply and offtake to reduce market dependency and improve financial stability.

- Ensure feedstock agreements are resilient to price volatility and supply chain disruptions.

- Offtake agreements should be structured with adequate duration and volume commitments to align with project financing and operational needs.

- Avoid over-reliance on government subsidies or incentives by ensuring project economics are robust under different market scenarios. Projects heavily dependent on subsidies may face financial challenges if incentives are reduced or withdrawn.

Summary of Mitigation Strategies

Strategy | Description | Expected Outcome |

Streamlined Decision-Making | Establish clear governance and use decision-support tools | Reduced decision bottlenecks |

Robust Feasibility Studies | Early, thorough assessments with contingency planning | Fewer uncertainties and informed FID |

Consistent communication with stakeholders using digital platforms | Stronger trust and alignment | |

Market Monitoring | Real-time tracking of conditions for optimal FID timing | Maximized market opportunities |

Early Procurement Strategies | Advance agreements for critical components | Minimized supply chain disruptions |

Regulatory Advocacy | Proactive engagement with regulatory bodies | Fewer approval delays |

Incorporating Risk Analysis | Use tools like risk registers and sensitivity analysis | Quantified risks with mitigation plans |

Commercial Agreements | Secure long-term feedstock and offtake agreements | Improved financial and market stability |

Case Study: Delayed FID in a Major Energy Project

Project Overview: A $1 billion LNG export terminal faced an 18-month delay in FID due to unresolved stakeholder disagreements and market volatility.

Impacts:

- Project costs increased by 20% due to inflation and supply chain disruptions.

- The delay allowed a competitor to secure key contracts in the target market.

- The project faced new permitting requirements, adding further delays.

Resolution:

- The company implemented streamlined governance processes and re-engaged stakeholders through targeted communication.

- Advance procurement of critical components minimized further delays once FID was approved.

- Despite the challenges, the project achieved financial close with revised timelines and budgets.

Conclusion

While Final Investment Decisions are pivotal milestones, their timing must be managed with precision to avoid hidden risks. Delays in FID can cascade into escalating costs, disrupted supply chains, regulatory hurdles, and lost market opportunities, jeopardizing project success. Additionally, it is equally important to recognize when a project should not proceed to FID. Clear off-ramps and a commitment to data-driven decision-making ensure resources are allocated effectively and potential losses are minimized.

By adopting proactive strategies, such as stakeholder alignment, robust feasibility studies, and early procurement, companies can mitigate the risks associated with delayed FIDs and maintain project viability. In an increasingly competitive and dynamic industrial landscape, timely and informed FIDs are not merely decisions—they are strategic imperatives. Organizations that prioritize efficient decision-making and risk management will be better positioned to navigate uncertainties and deliver successful outcomes for their projects.

Disclaimer

The information provided in this post is for reference purposes only and is intended to serve as a guide to highlight key topics, considerations, and best practices. It does not constitute professional advice or a substitute for consulting regarding specific projects or circumstances. Readers are encouraged to evaluate their unique project needs and seek tailored advice where necessary. Please Contact Us to discuss your particular project.