Energy projects are rife with uncertainties. From fluctuating material prices to labor shortages and unexpected regulatory delays, these risks can significantly impact project timelines and budgets. Traditionally, risks have been managed in silos, clients and contractors individually shouldering risks based on their perspectives. This often leads to inflated estimates, inefficiencies, and strained relationships.

Risk-sharing agreements, however, represent a transformative approach. By promoting collaboration, transparency, and equitable distribution of responsibilities, these agreements ensure risks are managed by the parties best equipped to handle them. This not only enhances project outcomes but also fosters trust among stakeholders.

In this article, we’ll explore the concept of risk-sharing agreements, their benefits, practical implementation, and how they are setting a new standard for collaborative estimating and project execution.

What is a Risk-Sharing Agreement?

A risk-sharing agreement is a contractual framework that encourages collaboration by distributing risks among project stakeholders. Instead of relying on one party to bear the financial or operational consequences of a risk, responsibilities are assigned based on capability, control, and influence over the risk.

Core Principles of Risk-Sharing Agreements:

- Joint Risk Identification: All stakeholders work together to identify potential risks during the estimating phase.

- Shared Risk Assessment: Risks are quantified for their likelihood and impact using data-driven tools.

- Equitable Allocation: Risks are distributed to the parties best equipped to manage or mitigate them.

- Collaborative Mitigation: Strategies to reduce risks are developed and implemented collectively.

- Defined Financial Terms: A framework for sharing costs, caps, and triggers is established to ensure transparency.

How Risk-Sharing Agreements Differ from Traditional Models

Aspect | Traditional Approach | Risk-Sharing Agreement |

Risk Responsibility | Risks are isolated and managed independently. | Risks are shared based on expertise and control. |

Transparency | Limited disclosure of risk assumptions. | Open and transparent discussions about risks. |

Contingencies | High contingencies to cover unknown risks. | Lower contingencies due to proactive risk allocation. |

Collaboration | Minimal collaboration between parties. | High collaboration with shared ownership of outcomes. |

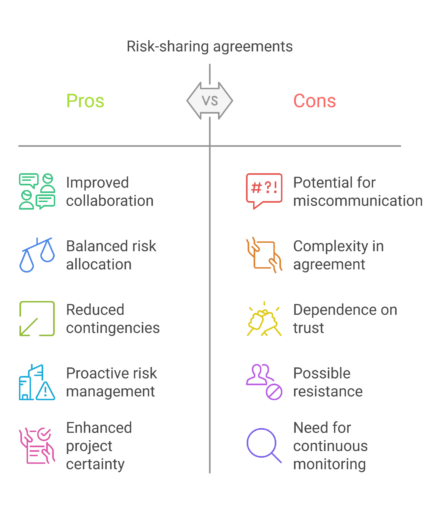

Why Risk-Sharing Agreements Matter

Improved Collaboration and Trust

Risk-sharing agreements inherently require open communication and transparency. This builds a collaborative environment where all parties work toward common goals instead of engaging in adversarial negotiations.

Example: A contractor might disclose detailed cost data on labor productivity to clarify why additional contingencies are required, fostering trust with the client.

Balanced Risk Allocation

Assigning risks to the parties most capable of managing them ensures fairness and efficiency. It prevents one party from shouldering undue responsibility and reduces the likelihood of disputes.

Example: A client assumes responsibility for securing regulatory approvals, while the contractor manages risks related to material procurement and labor availability.

Reduced Contingencies

By addressing risks collaboratively, stakeholders can lower the overall contingency included in estimates. This leads to more competitive and realistic project budgets.

Example: Instead of including a 20% contingency for material price fluctuations, a risk-sharing agreement might allocate this risk to the client, reducing the contractor’s contingency to 10%.

Proactive Risk Management

Collaborative risk-sharing encourages stakeholders to address risks early, mitigating their potential impact on the project.

Example: Locking in long-term contracts with material suppliers mitigates the risk of price escalation, reducing uncertainty for both clients and contractors.

Enhanced Project Certainty

By collaboratively addressing risks and creating contingency plans, stakeholders can achieve greater confidence in project budgets and schedules.

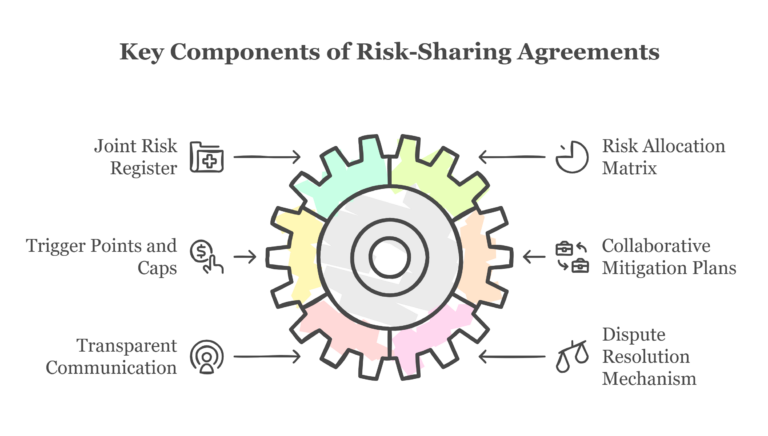

Key Components of a Risk-Sharing Agreement

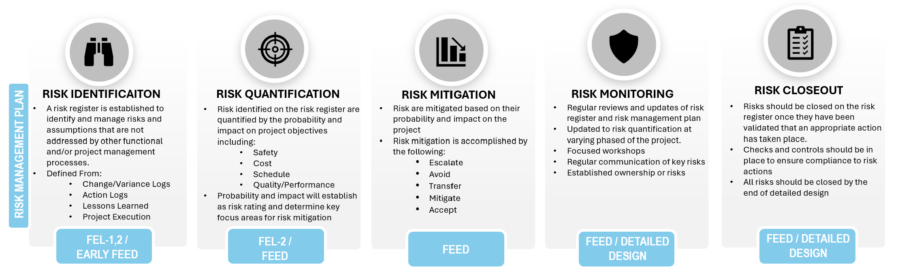

Joint Risk Register

A risk register is a centralized document that identifies, categorizes, and tracks risks throughout the project lifecycle. In a risk-sharing agreement, the register serves as a collaborative tool for transparency and accountability.

Contents:

- Risk descriptions (e.g., material shortages, labor strikes).

- Risk owners (e.g., client, contractor, or shared).

- Mitigation strategies.

- Financial terms.

The risk register also ensures that updates are consistently tracked and communicated to all stakeholders, serving as a dynamic tool rather than a static document.

Risk Allocation Matrix

The matrix clarifies who is responsible for each risk and the associated financial implications. This ensures all parties understand their obligations and the agreed-upon boundaries of their responsibilities.

Expanded Example:

Risk | Responsible Party | Mitigation Strategy | Financial Terms |

Material Price Volatility | Client | Fixed-price contracts with suppliers. | Client absorbs first 5% increase. |

Labor Productivity | Contractor | Workforce training and resource allocation. | Contractor absorbs cost overruns. |

Regulatory Delays | Client | Expedite permitting processes. | Client covers associated delays. |

Weather Interruptions | Shared | Flexible scheduling with buffer periods. | Both parties share 50/50 costs. |

By detailing both mitigation strategies and financial terms, the matrix acts as a roadmap for navigating risks effectively.

Trigger Points and Caps

Trigger points define when risk-sharing mechanisms are activated, while caps limit the financial exposure for any party. These mechanisms ensure clarity and prevent excessive financial burdens from falling on one stakeholder.

Expanded Example:

- A contractor absorbs the first 5% of cost overruns on materials. Beyond that threshold, the client and contractor split costs 50/50, but only up to a cap of $1 million. Any excess cost requires joint renegotiation.

- Caps can also include time delays, where penalties or shared costs are triggered if delays exceed pre-defined durations.

Collaborative Mitigation Plans

Stakeholders jointly develop and execute plans to reduce the likelihood and impact of identified risks. This collaboration ensures that mitigation strategies are feasible and address the priorities of all parties.

Example: Developing a workforce training program for addressing potential labor shortages could involve shared funding, with the client covering initial costs and the contractor implementing the program.

Transparent Communication

Regular updates and meetings are essential for maintaining alignment and addressing emerging risks. Collaborative tools, such as shared dashboards or project management platforms, provide real-time updates that ensure visibility for all parties.

Best Practices:

- Use centralized communication hubs to track project updates.

- Schedule bi-weekly risk assessment meetings to revisit the risk register and allocation matrix.

Dispute Resolution Mechanism

A clear process for resolving disagreements about risk allocation or financial terms minimizes disruptions. Establishing structured mechanisms ensures that conflicts are resolved quickly and do not escalate unnecessarily.

Detailed Resolution Process:

- Informal Discussion: Initial discussions between the parties involved.

- Mediation: Engage a neutral third-party mediator to facilitate a resolution.

- Arbitration or Litigation: As a last resort, formal legal processes can be pursued with clear terms defined in the agreement.

Including these steps in the agreement ensures all stakeholders are aligned on how disputes will be handled, reducing uncertainty during conflicts.

Implementing Risk-Sharing Agreements in Project Estimating

Early Engagement of Stakeholders

Initiate discussions about risks and responsibilities during the estimating phase to ensure alignment from the outset.

Data-Driven Risk Assessment

Leverage tools like Monte Carlo simulations or sensitivity analyses to quantify risks and inform decision-making.

Development of Financial Frameworks

Collaboratively establish cost-sharing mechanisms, such as caps, proportional splits, or incentive structures.

Example: A contractor receives a bonus if labor productivity exceeds benchmarks, reflecting shared risk and reward.

Integration with Estimates

Incorporate risk-sharing terms into the project estimate, clearly reflecting the shared responsibilities and financial arrangements.

Continuous Monitoring and Adjustment

Revisit risk-sharing agreements as the project progresses, updating terms to reflect new risks or conditions.

Case Study: Risk-Sharing in Action

Project Overview:

A $600 million petrochemical facility faced significant risks, including material price volatility, labor shortages, and stringent regulatory approvals.

Risk-Sharing Framework:

- Material Price Volatility:

- The client absorbed price increases beyond 5%.

- The contractor secured fixed-price contracts for high-risk materials.

- Labor Shortages:

- The contractor implemented a workforce training program, with the cost shared equally by the client.

- Regulatory Approvals:

- The client took full responsibility for permitting, with the contractor compensated for delays exceeding 30 days.

Outcome:

The collaborative framework reduced contingencies by 12%, and the project was completed within 4% of the original budget despite unforeseen challenges.

Challenges in Risk-Sharing Agreements

Resistance to Transparency

Some stakeholders may hesitate to disclose cost data or risk assumptions, fearing it could weaken their negotiating position.

Solution: Emphasize mutual benefits and build trust through consistent communication.

Difficulty in Quantifying Risks

Complex or novel risks can be challenging to measure accurately.

Solution: Use advanced risk analysis tools, such as Primavera Risk Analysis or @Risk, to model potential outcomes.

Misaligned Priorities

Conflicting goals, such as minimizing costs versus accelerating schedules, can create friction.

Solution: Establish shared objectives and align incentives to promote collaboration.

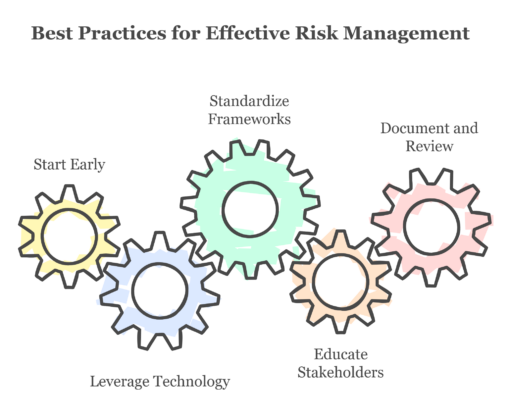

Best Practices for Risk-Sharing Agreements

- Start Early: Begin discussions about risks and responsibilities during the conceptual phase.

- Leverage Technology: Use collaborative tools to track and analyze risks in real time.

- Standardize Frameworks: Develop templates for risk-sharing agreements to streamline implementation across projects.

- Educate Stakeholders: Provide training on risk management principles to foster a collaborative mindset.

- Document and Review: Maintain detailed records of agreements and revisit them regularly to ensure relevance.

Conclusion

Risk-sharing agreements represent a forward-thinking approach to project estimating and execution. By fostering collaboration, promoting transparency, and distributing responsibilities equitably, these agreements enable stakeholders to manage uncertainties more effectively.

In an era where industrial projects are increasingly complex and volatile, adopting risk-sharing agreements can drive better outcomes, build stronger relationships, and ensure long-term success.

The future of project estimating lies in collaboration, and risk-sharing agreements are a key step toward achieving this vision. For tailored guidance on implementing these agreements, contact us today to explore how we can enhance your project outcomes.

Appendix – Expanded Strategies for Risk Mitigation

To manage risks effectively, project teams must adopt a structured approach that includes:

Risk Identification and Quantification

- Use tools such as risk registers and risk matrices to systematically identify and prioritize risks.

- Employ advanced software tools for data collection and trend analysis to uncover hidden risks.

- Conduct scenario planning workshops to simulate potential challenges and outcomes.

- Leverage historical data and lessons learned from similar projects to anticipate challenges and prepare accordingly.

Mitigation Planning

- Develop tailored strategies for each identified risk, ensuring alignment with project objectives.

- Escalate risks to senior management or governing bodies when they exceed the project team’s control.

- Avoid risks by redesigning processes, adjusting plans, or altering site selection.

- Transfer risks through contracts, warranties, insurance policies, or partnership agreements.

- Mitigate risks by implementing proactive measures such as redundancies, enhanced training, or additional resources.

- Accept low-impact risks while ensuring a robust monitoring mechanism is in place to respond swiftly to any changes.

Monitoring and Control

- Assign risk ownership with clearly defined responsibilities and accountability frameworks.

- Conduct routine risk reviews and audits to evaluate mitigation effectiveness and uncover new risks.

- Implement real-time monitoring systems to track key performance indicators and potential triggers.

- Establish automated alert systems to provide early warnings of emerging risks.

Stakeholder Engagement

- Develop a comprehensive stakeholder engagement strategy that includes frequent communication channels.

- Organize collaborative risk workshops with key stakeholders to ensure inclusivity in the risk assessment process.

- Provide transparent updates on risk status and mitigation efforts to maintain trust and alignment.

- Use stakeholder feedback loops to refine risk strategies and address concerns promptly.

Documentation and Lessons Learned

- Maintain a dynamic risk register that evolves with project milestones and phases.

- Document case studies and post-mortem analyses of both successes and failures to create a repository of actionable insights.

- Create standardized templates and guides for risk management processes to streamline future projects.

- Foster a culture of continuous learning by encouraging teams to share knowledge and participate in cross-project reviews.

Contingency Planning

- Set aside contingency funds and time buffers proportional to the identified risk profile.

- Develop detailed contingency action plans for high-probability, high-impact risks, including step-by-step responses.

- Integrate contingency plans into the overall project schedule to ensure seamless implementation during disruptions.

- Regularly revisit and update contingency measures as new risks emerge or project parameters change.

Disclaimer

The information provided in this post is for reference purposes only and is intended to serve as a guide to highlight key topics, considerations, and best practices. It does not constitute professional advice or a substitute for consulting regarding specific projects or circumstances. Readers are encouraged to evaluate their unique project needs and seek tailored advice where necessary. Please Contact Us to discuss your particular project.